Fidelity 500 Index Fund (FXAIX) Review

FXAIX - A Comprehensive Overview

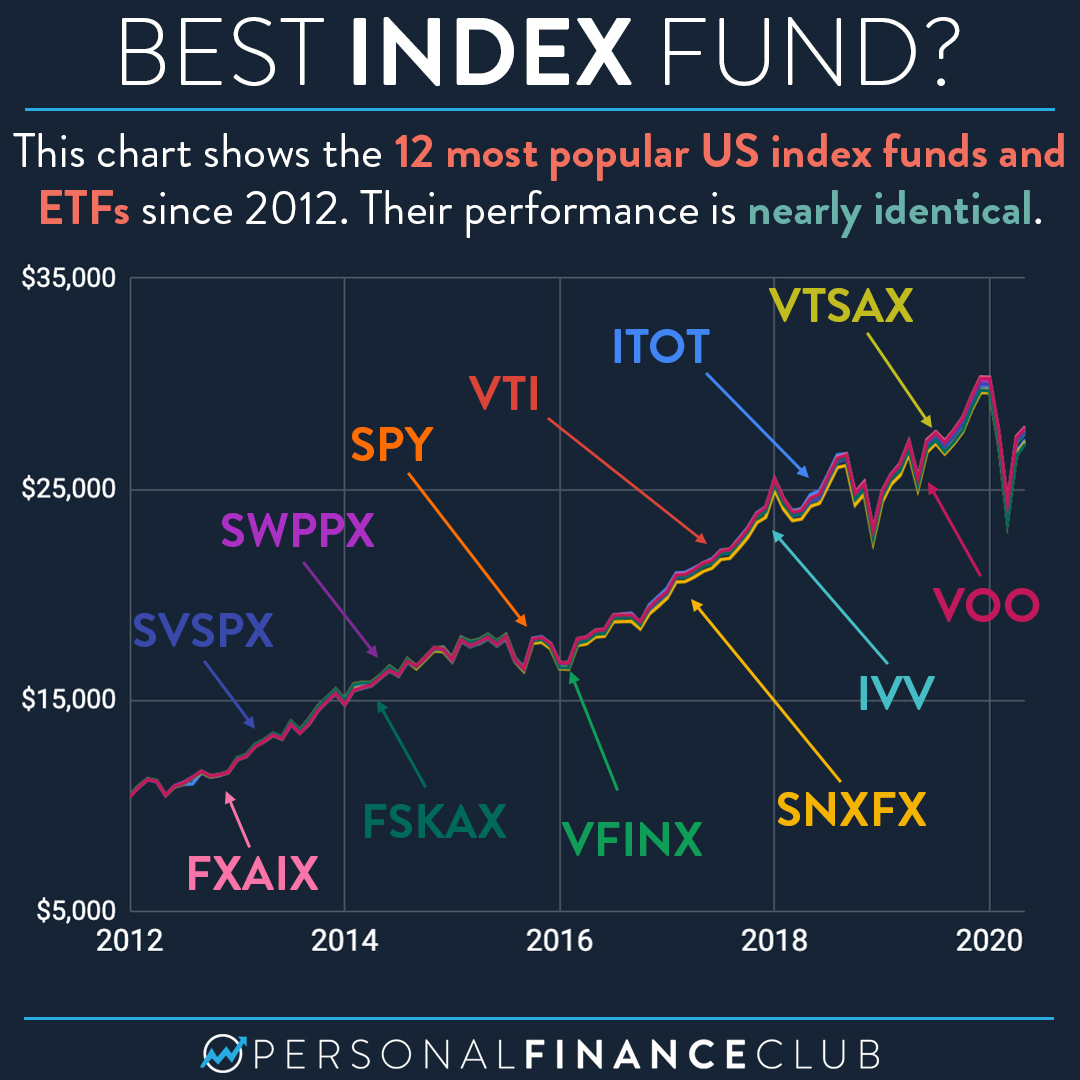

The Fidelity 500 Index Fund (FXAIX) is a mutual fund that tracks the S&P 500 index, one of the main benchmarks for US stocks. The index covers about 80% of the investable market, making it a well-diversified investment. FXAIX is one of the largest mutual funds in the market, with over $300 billion in assets under management. It is also a low-cost index fund, with an expense ratio of just 0.015%. This makes it a great option for investors who are looking for a low-cost way to invest in the S&P 500 index.

Investment Performance

FXAIX has a long history of strong investment performance. Over the past 10 years, it has returned an average of 9.9% per year. This is well above the average return of the S&P 500 index, which has returned an average of 7.5% per year over the same period. FXAIX's strong performance is due to its low fees and its exposure to the growth of the US stock market.

Risks

Like all investments, FXAIX is subject to risks. The main risk is that the value of the S&P 500 index could decline, which would cause the value of FXAIX to decline as well. However, the S&P 500 index has a long history of growth, so this risk is relatively low. Another risk is that FXAIX is a passively managed fund, which means that it does not try to beat the market. This means that FXAIX's performance will be closely tied to the performance of the S&P 500 index.

Conclusion

FXAIX is a well-diversified, low-cost index fund that tracks the S&P 500 index. It has a long history of strong investment performance and is a good option for investors who are looking for a low-risk, low-cost way to invest in the US stock market.

Komentar